Dow Jones Industrial Average lags as investors await Fed rate cuts

- The Dow Jones stuck close to 45,500 on Monday as investors take a pause.

- Markets are still banking heavily on a Fed rate cut next week.

- CPI inflation expected to accelerate again this Thursday.

The Dow Jones Industrial Average (DJIA) churned chart paper on Monday, finding a near-term floor at the 45,400 level. Investors continue to lean into bets that the Federal Reserve (Fed) will deliver an interest rate cut on September 17.

Other major indexes with larger exposure to tech rally components left the Dow behind on Monday. The Dow Jones held near flat to kick off the new trading week, while the tech-focused Nasdaq climbed into a fresh record high. The Dow is holding steady near record highs above 45,761, but investors are awaiting a fresh turn of the macro data page before stepping back into firmer bids.

Markets maintain bets for upcoming rate cut

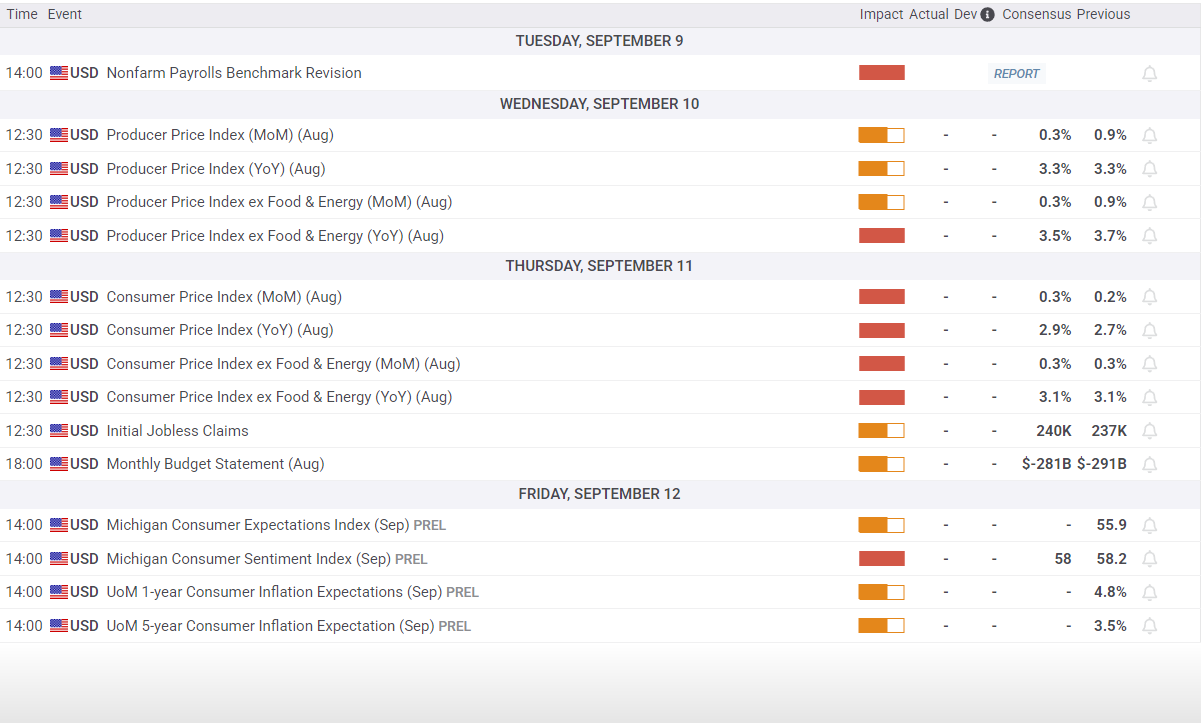

Last week’s worse-than-expected Nonfarm Payrolls (NFP) jobs report cemented investor expectations that the Fed will trim interest rates next week. However, this week’s upcoming Consumer Price Index (CPI) inflation print remains a key barrier. Inflation data has remained stubbornly above the Fed’s 2% top-line target, with functionally no progress on defeating inflation for most of the year.

The Bureau of Labor Statistics’ (BLS) annual benchmark revision for current employment statistics data is also due this week. Over the past decade, benchmark revisions have averaged 0.1% adjustments to final employment numbers, but the Trump administration's ongoing politicization of both the Fed and the BLS will put any adjustments to figures under a microscope.

BLS benchmark adjustments are slated for Tuesday, with CPI inflation figures due on Thursday.

Dow Jones daily chart

Economic Indicator

Consumer Price Index (YoY)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as The Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The YoY reading compares the prices of goods in the reference month to the same month a year earlier.The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Thu Sep 11, 2025 12:30

Frequency: Monthly

Consensus: 2.9%

Previous: 2.7%

Source: US Bureau of Labor Statistics

The US Federal Reserve (Fed) has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.