Margin, Leverage &

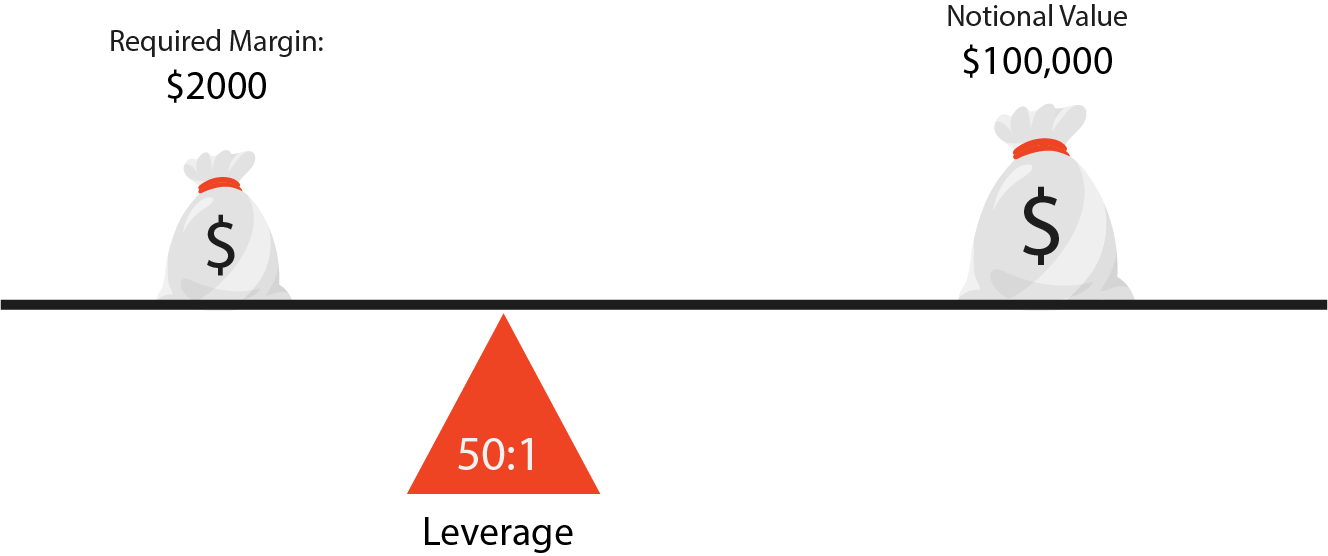

What is Margin & Leverage?

When trading in the foreign exchange market, you only need a small amount of capital to open and maintain a position. This capital is called margin. For example, if you want to buy EUR/USD worth $100,000, you do not need to pay the full amount, but only a small portion, such as $2,000. The amount of margin required depends on your forex broker or contract for difference provider. In simple terms, margin is the credit guarantee you provide to your broker or the guarantee that you have the ability to hold the trade until it is closed. Leverage is the ratio of the amount of capital used in the trade to the margin.

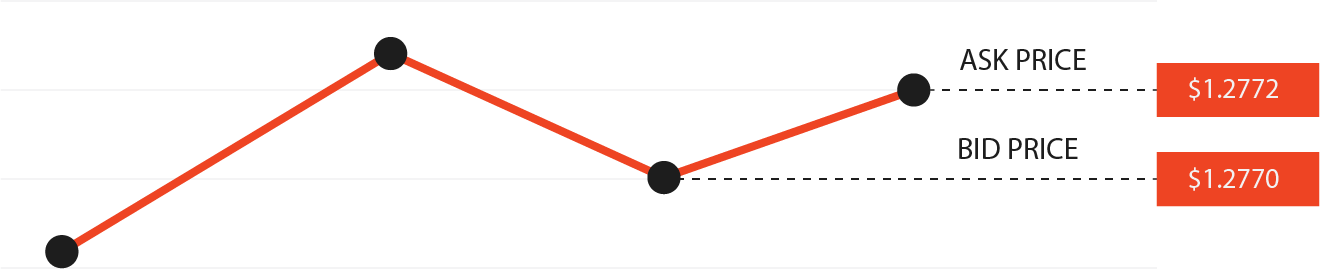

What is the Bid-Ask Spread?

Each currency pair has two prices: the bid price and the ask price. The "bid price" is the price at which you can sell the base currency, while the "ask price" is the price at which you can buy the base currency. The difference between these buy and sell prices is called the bid-ask spread, also known as the "buy-sell spread." For example, if you receive a quote for the EUR/USD currency pair at $1.2770/72, the former number is the "bid" price of $1.2770, while the latter number is the "ask" price of $1.2772. The difference between the two prices is $0.0002, which is the bid-ask spread, equivalent to 2 pips.